THE proposed land bridge spanning Thailand’s Isthmus of Kra will end up as a white elephant due to its total irrelevance and unsuitability as an alternative to the centuries-old dream of a canal traversing the Isthmus of Kra.

Thailand where the term’ white elephant’ originated is now busy trying to create a new one under the present shortsighted government.

No matter how one looks at it a canal, not a land bridge, is the best solution in terms of costs, efficiency, convenience and profitability apart from a host of other socio-economic factors.

The reason why there is hardly any or only a lukewarm response to the land bridge project is that investors realise the folly of this white elephant project.

Other than the huge cost involved for the land bridge, equivalent to dredging the canal, it is not going to be economically sustainable, and no shipping company would want to incur additional costs by unloading their merchandise on one side, having it transported by land and having them loaded again on the other side.

This is the main reason why a normally enthusiastic and ambitious China is avoiding it like a hot potato. The Kra Canal was supposed to be part of the Chinese brainchild, the BRI.

One cannot understand why the Thai government is considering the land bridge option when it can take the sensible and easy way out by opting for a canal. One should now consider the benefits the canal will bring.

Moreover, it looks like the present Thai administration is being goaded by vested interests to favour the land bridge despite its economic unviability.

The Thai people will be burdened by the loss-making landbridge in the future. The cost of the landbridge is estimated at around US$28 bil whereas the Kra canal was estimated to cost 20 billion dollars when the initial proposal was made by China.

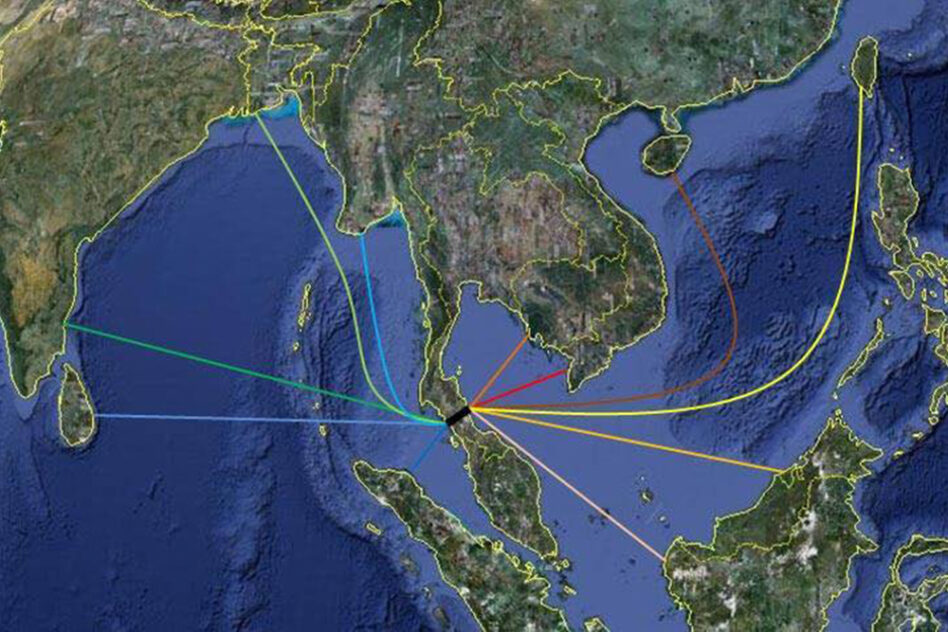

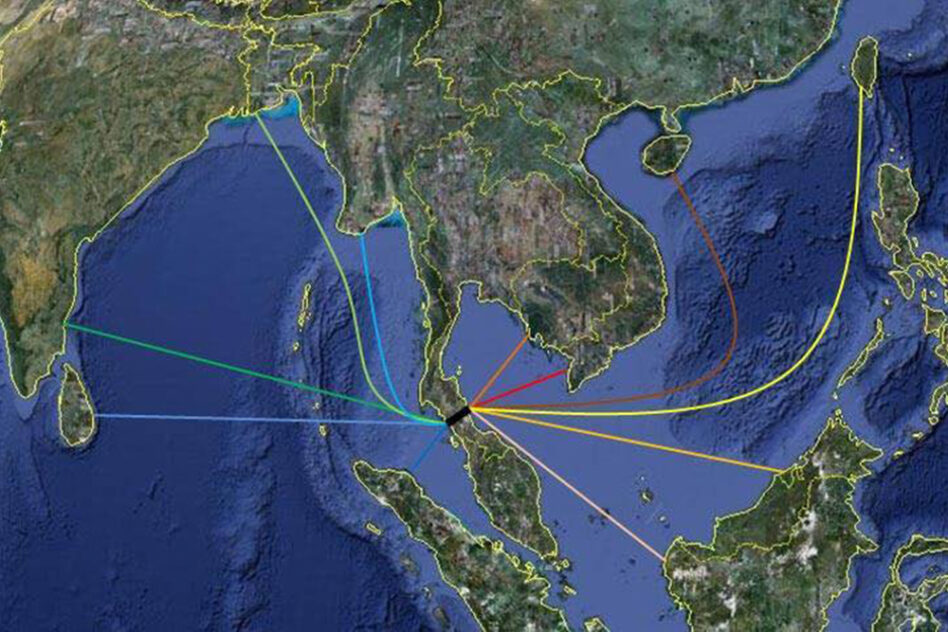

China prefers the canal instead of the land bridge and it is only logical to do so. There is also no need for the expensive lock system of the Panama Canal and thus it will be cheaper to operate and maintain. The canal will obviously shorten the route by 1200 nautical miles for trade among the South Asian, East Asian and the Asean countries not to mention for other nations in the Indo-Pacific.

Much pressure could be relieved on the Straits of Malacca, which is now facing risks like congestion, maritime accidents, pollution and sometimes piracy. The Straits could become a point to choke supplies in case of a war between the major powers, and this will also threaten the littoral states.

All the regional and neighbouring nations will immensely benefit from the canal as lower costs could expand trade and demand. Malaysia’s northern region, now devoid of any major trade connections or major economic development, could benefit from the canal.

The northern area is now served by the NSE, the East Coast Highway, and the soon-to-be opened ECRL. More road and rail connections between Malaysia and Thailand could occur in the future. The northern states of the peninsula, long deprived of any catalysts for progress, could see investments and trade enhanced due to the canal. There are also unfounded fears that the construction of the canal could cause ecological and environmental damage.

Excavating the canal using the latest technological advances and hi-tech machinery, unlike the time of construction of the Suez and Panama Canals will minimise or control damage, which can be rehabilitated in due course.

However, one needs to consider the benefits the excavation brings. The vast amount of earth dug up could be used to raise the adjacent areas, as some of these areas are prone to flooding. The vast levelled and raised areas running parallel to the canal on either side could be used to build new townships, industrial parks, and residential areas and trigger major development in this poverty-stricken province.

Roads and highways on the raised area spanning the length of the canal could be a bonus of the canal excavation. Oil and gas pipelines, if needed can be laid parallel to the canal.

Underground tunnels, like the one between France and the UK can be built for vehicular traffic to traverse from north to south without having to build costly overhead bridges that will be needed to facilitate the passage of large ships.

Ports can be built on either end of the canal facing the sea, and it will enhance trade and transport connections that benefit all the neighbouring regions, including the northern Malayan peninsula.

Despite China enhancing facilities in the South China Sea islands that it controls and India also beginning to develop the Andamans and Nicobar as part of its strategic interests, the Kra canal should, as a condition, be utilised by ships only for peaceful purposes taking into consideration the Zopfan concept of Asean.

The canal can be built, ideally, by a conglomerate of Asean nations together with South and East Asian nations. If this is not possible then maybe China could do it on its own, as it is eager to realise this dream project with the cooperation of Thailand.

For China the Kra Canal will be more worthy than its investments in some sections of the BRI which run through mountainous, remote, and problematic areas.

Thailand need not consider the opposition of some countries, such as Singapore and the US to the canal project. Singapore is very advanced, is one of the richest countries today and does not rely on its maritime port for economic survival as was the case several decades ago. Singapore should not block efforts towards the realisation of the canal through its influence in Asean.

Thailand’s socio-economic development is more important. The US has an axe to grind against China and does not want China to be dominant in this region. It is hoped that the canal will not be victimised and aborted due to the Indo-Pacific rivalry.

Thailand also worries about the canal serving as a religious/ethnic divide line, which can aid separatism. It should be noted that both the communist and religious insurgencies of the past occurred mainly due to poverty and marginalisation of the communities. Major developments and investments due to the canal will boost the socio-economic well-being of the people in the provinces.

Tourism in the Asean and nearby regions will get a big boost, especially with cruise liners plying the string of littoral states in the region and becoming more popular due to the canal. The Kra Canal itself could be a tourist draw! Can the land bridge do the same?

Just as the opening of the Suez and Panama Canals brought about major developments in international maritime trade and development in the Atlantic and Pacific regions, the Kra Canal could be the harbinger heralding the dawn of the Asian Century, when Asia overtakes both Europe and North America politically and economically and becomes the dominant continent it once was.